On Thursday, in a development that potentially brings a closure to Toshiba Corp’s sale of its NAND chip business, the Japanese giant signed a $18 billion (£13.4 billion) deal to sell its chip unit to a consortium led by Bain Capital LP.

With this, Toshiba has crossed over a key hurdle, as it scrambles for funds to to stave off a potential de-listing from the Tokyo stock exchange.

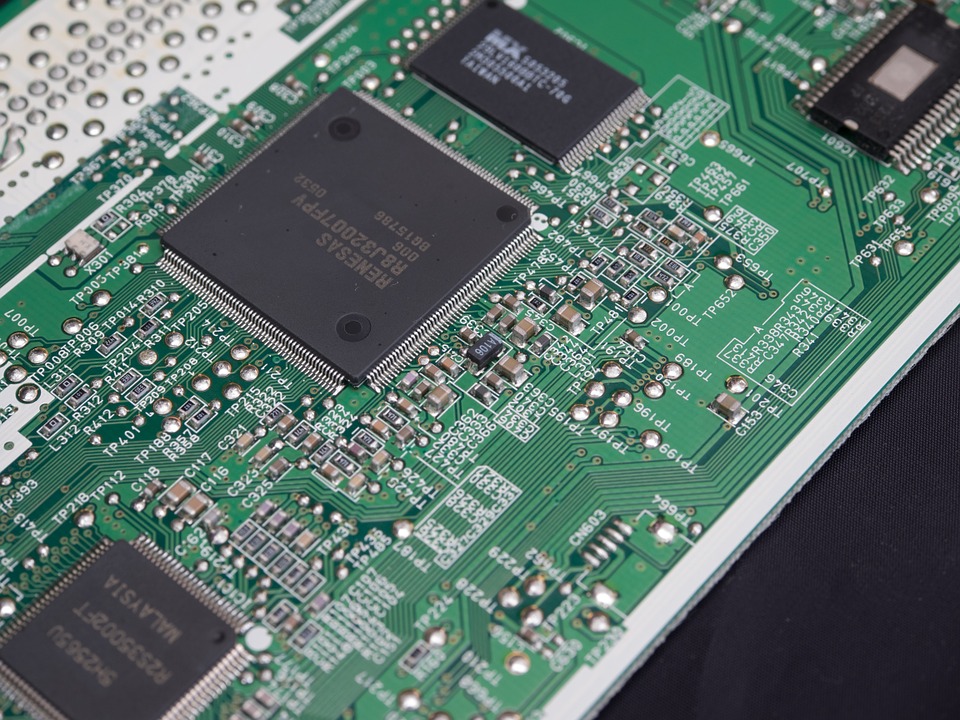

The development marks the sale of the world’s second largest producer of NAND chips.

According to sources familiar with the matter at hand, the signing of the deal was delayed thanks to Apple, which demanded new terms over the supply of chips in return for funding.

The Bain Capital consortium includes Dell Inc, Kingston Technology, South Korean chipmaker SK Hynix and Seagate Technology Plc.

Changing alliances, revised bids and pressure from the Japanese government had heightened the risks that the deal may not close before the end of Japan’s financial year in March, since regulatory reviews usually take at least six months.

If the deal does not close before then, it will result in Toshiba, reporting for a second consecutive year, a negative net worth, which could potentially see it de-listed from the Tokyo Stock Exchange.

The sale also faces legal challenges from Western Digital, a rejected suitor who is also Toshiba’s chip joint venture partner, which is seeking an injunction to block any deal that does not have its consent.

In 2016, Western Digital acquired SanDisk for $16 billion and has been Toshiba’s joint venture partner since 2000. It is also a leader in the hard drives market. The company sees the chip business as a key pillar of growth and is thus desperately trying to keep out rivals from deepening their foothold in the chip business.

Source: