The increase in the sales tax rate is an "extremely important step," although the spending program creates a "bad precedent" for future tax increases, said one of supporters of the debt repayment, who holds a position in the Tax Commission and advises the Cabinet and Ministry of Finance.

Another long-time advocate of expansionary fiscal policy and an adviser to the cabinet secretary praised the prime minister's efforts to increase spending, yet expressing disappointment that the tax increase was not postponed until inflation is noted.

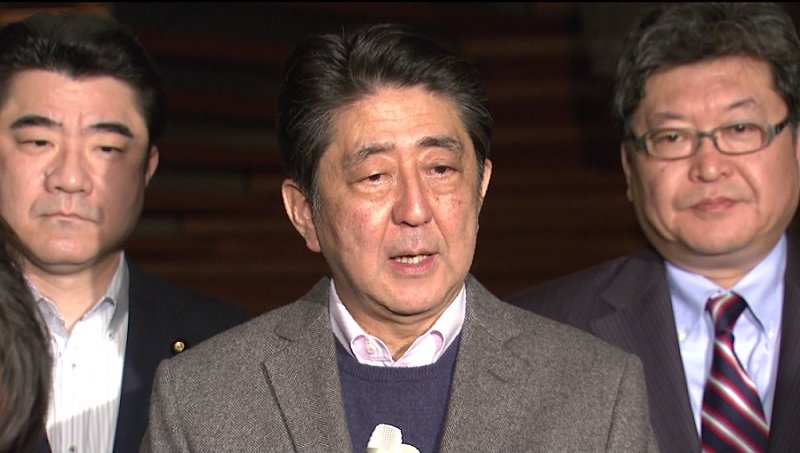

Neither of them, however, expressed extreme praise for Abe's economic plans. Yet, the lack of heated debate is a positive moment for the prime minister ahead of next month's elections.

A professor at the University of Kyoto said that the best thing the government can do is ultimately liquidate the tax and rely on revenues and corporate taxes instead.

Another professor at the Keio University in Tokyo expects that the tax will grow to 15-20% by mid-2020, given Japan's debt burden and the growing burden on social security.

Abe said that sales tax will grow from 8% to 10% in October 2019unless there is an economic crisis. The last time the tax was increased in April 2014 from 5%. Then, the economy entered a phase of recession.

This week, Finance Minister Taro Aso and Economy Minister Toshimitsu Motegi both indicated that achieving a surplus in the primary balance by the fiscal year 2020 looks unlikely if Abe plans to redirect the proceeds from the sales tax and shift from paying debts to financing educational programs.

Achieving a surplus of the primary balance can be postponed, but not for long, and debt reduction must be achieved in order to reduce the level of inequality between generations, as the population of Japan is aging and its number is getting smaller.

According to the Cabinet, the deficit of the primary balance, which includes the government's total spending minus interest payments on debts against tax revenues, is projected to number 18.4 trillion yen ($ 163 billion) in this fiscal year.

According to Fuji, the government should instead focus on reducing the ratio of domestic debt to gross domestic product. From this point of view, the key point is the growth of the economy, and it does not matter if the nominal debt grows, while GDP is expanding faster.

The state debt burden of Japan remained quite stable at the rate of 240% of GDP in recent years, according to the calculations of the International Monetary Fund.

Both experts agreed that the government should limit the annual growth of social security spending to 500 billion yen.

Tobias Harris, Vice President of Teneo Intelligence, a political risk consulting company, said that Abe showed that he knows how to reassure rivals and make his supporters happy, even if the fault lines reopen later.

"This is a classic way of Abe's behavior," Harris said.

source: bloomberg.com

Another long-time advocate of expansionary fiscal policy and an adviser to the cabinet secretary praised the prime minister's efforts to increase spending, yet expressing disappointment that the tax increase was not postponed until inflation is noted.

Neither of them, however, expressed extreme praise for Abe's economic plans. Yet, the lack of heated debate is a positive moment for the prime minister ahead of next month's elections.

A professor at the University of Kyoto said that the best thing the government can do is ultimately liquidate the tax and rely on revenues and corporate taxes instead.

Another professor at the Keio University in Tokyo expects that the tax will grow to 15-20% by mid-2020, given Japan's debt burden and the growing burden on social security.

Abe said that sales tax will grow from 8% to 10% in October 2019unless there is an economic crisis. The last time the tax was increased in April 2014 from 5%. Then, the economy entered a phase of recession.

This week, Finance Minister Taro Aso and Economy Minister Toshimitsu Motegi both indicated that achieving a surplus in the primary balance by the fiscal year 2020 looks unlikely if Abe plans to redirect the proceeds from the sales tax and shift from paying debts to financing educational programs.

Achieving a surplus of the primary balance can be postponed, but not for long, and debt reduction must be achieved in order to reduce the level of inequality between generations, as the population of Japan is aging and its number is getting smaller.

According to the Cabinet, the deficit of the primary balance, which includes the government's total spending minus interest payments on debts against tax revenues, is projected to number 18.4 trillion yen ($ 163 billion) in this fiscal year.

According to Fuji, the government should instead focus on reducing the ratio of domestic debt to gross domestic product. From this point of view, the key point is the growth of the economy, and it does not matter if the nominal debt grows, while GDP is expanding faster.

The state debt burden of Japan remained quite stable at the rate of 240% of GDP in recent years, according to the calculations of the International Monetary Fund.

Both experts agreed that the government should limit the annual growth of social security spending to 500 billion yen.

Tobias Harris, Vice President of Teneo Intelligence, a political risk consulting company, said that Abe showed that he knows how to reassure rivals and make his supporters happy, even if the fault lines reopen later.

"This is a classic way of Abe's behavior," Harris said.

source: bloomberg.com