Fred Taylor-Young

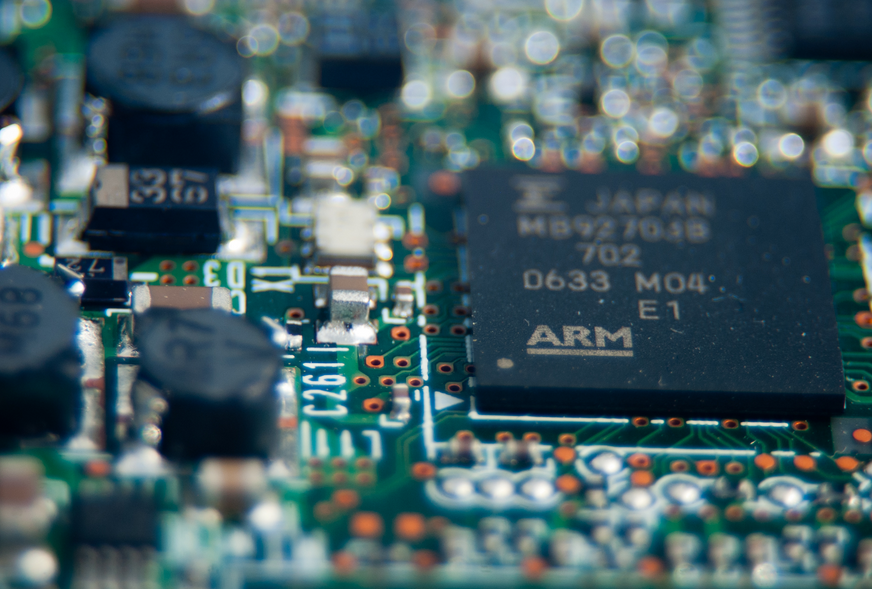

Arm raised $4.87 billion in an initial public offering (IPO), selling 95.5 million ADRs at $51 each. In the IPO, the company was valued at $54.5 billion.

Arm equities' initial trading began at $56.1, 10% more than the IPO price.

Arm's IPO was the biggest in the United States since Rivian's $13.7 billion IPO in November 2021.

Some of Arm's largest clients, including Intel Corp., Apple Inc., Nvidia Corp., Samsung Electronics Co., and Taiwan Semiconductor Manufacturing Company, participated in the IPO. Taiwan Semiconductor Manufacturing Company purchased ADRs worth more than $700 million.

SoftBank Group Corp. kept a 90% interest in Arm after the IPO.

source: bloomberg.com

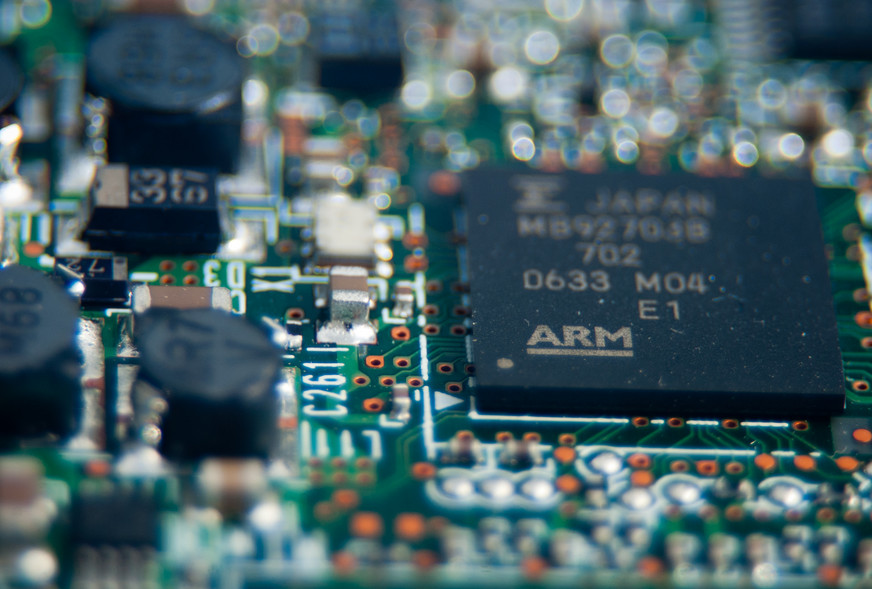

Arm equities' initial trading began at $56.1, 10% more than the IPO price.

Arm's IPO was the biggest in the United States since Rivian's $13.7 billion IPO in November 2021.

Some of Arm's largest clients, including Intel Corp., Apple Inc., Nvidia Corp., Samsung Electronics Co., and Taiwan Semiconductor Manufacturing Company, participated in the IPO. Taiwan Semiconductor Manufacturing Company purchased ADRs worth more than $700 million.

SoftBank Group Corp. kept a 90% interest in Arm after the IPO.

source: bloomberg.com