According to Bloomberg, this year, the share of issuers from China accounts for about 60% of bonds denominated in US dollars, in Asia outside of Japan. The sales will grow until they match China's dominant status in regional equity markets and GDP, said Salman Niaz, chief executive of the emerging markets bond market at Goldman Sachs Asset Management.

"The market of dollar bonds in China has not yet reached this level," Niaz told Bloomberg, "It is reasonable to expect that within the next three to five years China will have a 70-80% share in the Asian dollar bond market."

In pursuit of profitability, investors bought bonds for a record $ 224 billion offered in Asia outside Japan since early 2017, according to data compiled by Bloomberg.

Niaz expects that the volume of output in the region will approach $ 200 billion in the next year. According to him, the local supply is a good sign for the market in the long term. Accumulation of China and Japan should be involved, he said, noting also that with their combined balances, China's five largest insurance companies "can buy the Asian market several times."

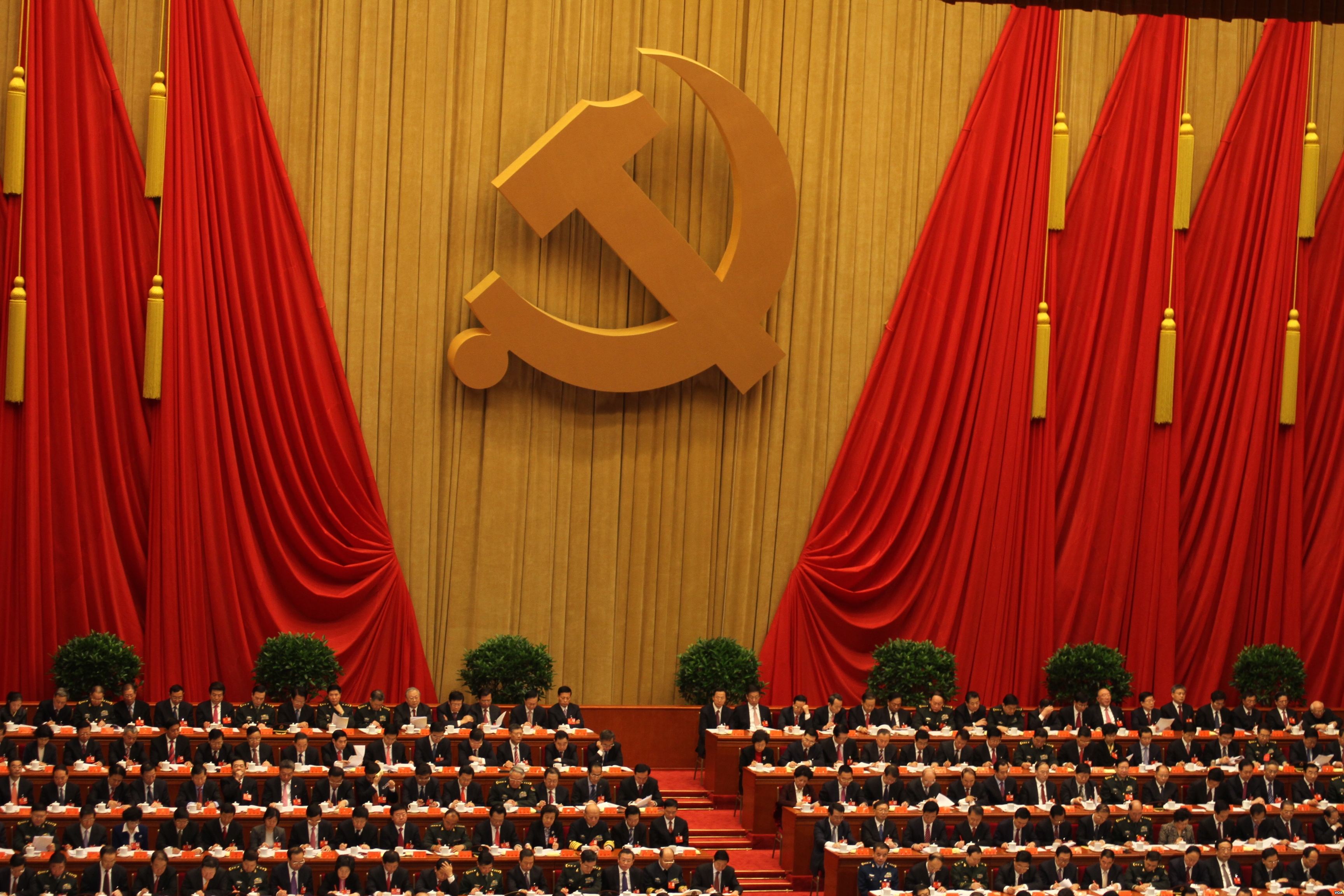

The biggest uncertainty will be the reshuffling of the country's leadership. In October, the 19th Congress of the Communist Party of China will be held. Nevertheless, Chairman Xi Jinping will probably continue the strategy of reforms in the sphere of reducing the share of borrowed funds, lending, the housing market and industries with excess production capacity, Niaz said.

Last week, the international rating agency S & P Global Ratings downgraded China's long-term sovereign credit rating for the first time since 1999 and revised the outlook from "negative" to "stable", pointing to the risks associated with debt growth.

The agency also warned this week that the trend of narrowing spreads on Asian bonds to almost ten-year lows in conditions of excess liquidity may end, as monetary incentives in different countries will inevitably decline.

source: bloomberg.com

"The market of dollar bonds in China has not yet reached this level," Niaz told Bloomberg, "It is reasonable to expect that within the next three to five years China will have a 70-80% share in the Asian dollar bond market."

In pursuit of profitability, investors bought bonds for a record $ 224 billion offered in Asia outside Japan since early 2017, according to data compiled by Bloomberg.

Niaz expects that the volume of output in the region will approach $ 200 billion in the next year. According to him, the local supply is a good sign for the market in the long term. Accumulation of China and Japan should be involved, he said, noting also that with their combined balances, China's five largest insurance companies "can buy the Asian market several times."

The biggest uncertainty will be the reshuffling of the country's leadership. In October, the 19th Congress of the Communist Party of China will be held. Nevertheless, Chairman Xi Jinping will probably continue the strategy of reforms in the sphere of reducing the share of borrowed funds, lending, the housing market and industries with excess production capacity, Niaz said.

Last week, the international rating agency S & P Global Ratings downgraded China's long-term sovereign credit rating for the first time since 1999 and revised the outlook from "negative" to "stable", pointing to the risks associated with debt growth.

The agency also warned this week that the trend of narrowing spreads on Asian bonds to almost ten-year lows in conditions of excess liquidity may end, as monetary incentives in different countries will inevitably decline.

source: bloomberg.com