The largest in mainland China manufacturer of molybdenum China Molybdenum Co. acquired Brazilian unit of Anglo American Plc, producing niobium and phosphates, reports Bloomberg. The deal cost the company $ 1.5 billion, which is 50% more than value expected by analysts.

Although the prices of niobium fell last year due to a decrease in demand for steel, there were at least 15 companies competing with China Molybdenum for the right to buy these assets. Among them were the global leader in the phosphate fertilizers production Mosaic, Australian producer of coal and steel South32 and Swiss chemical company EuroChem Group AG.

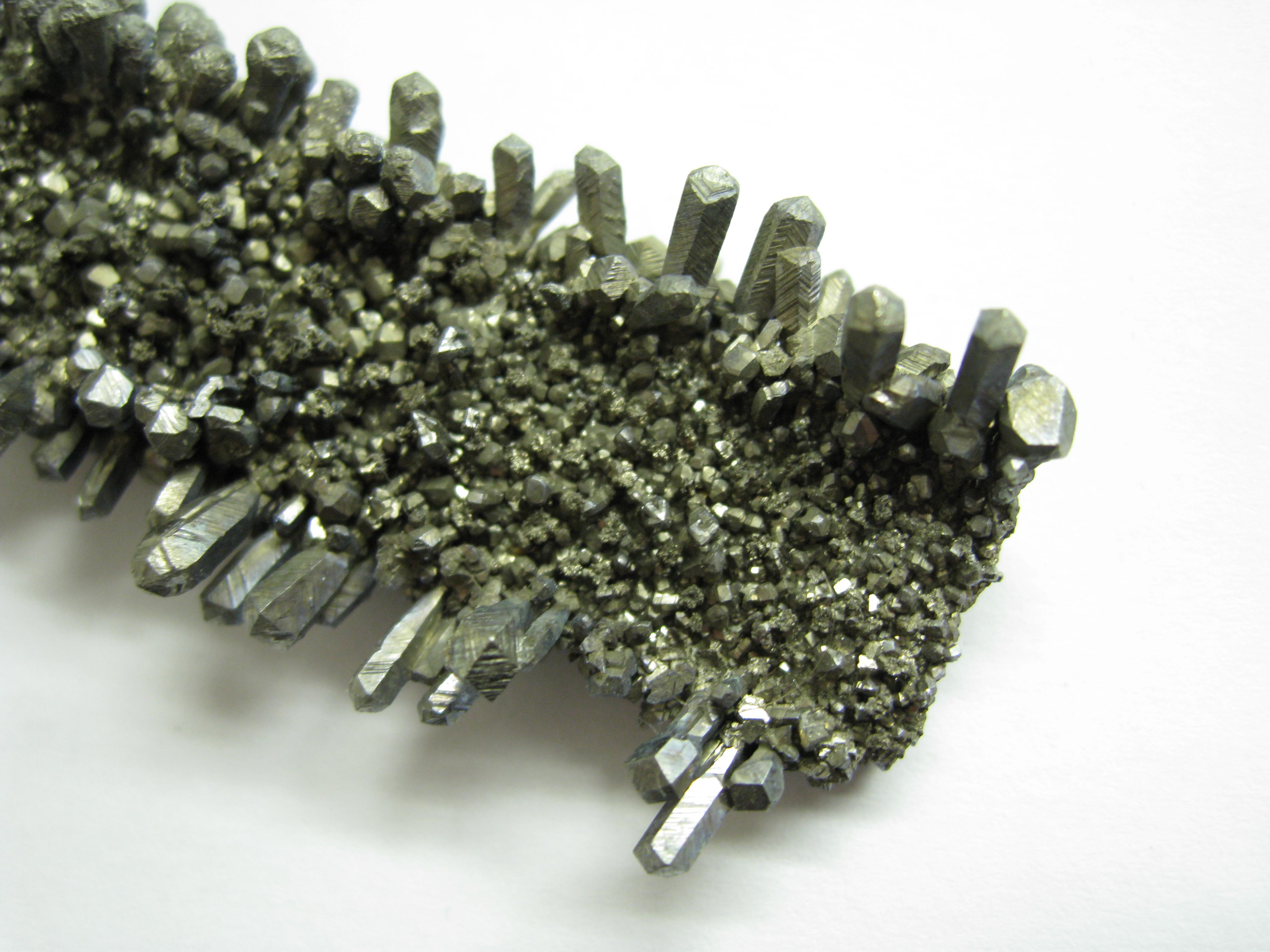

Niobium is a severe refractory metal opened in 1801, used in production since 1925. Possessing high ductility, corrosion resistance and good weldability, niobium is used in to produce more durable and light steel for manufacture of industrial pipes and aircraft parts.

About 85% of the world's supply of niobium falls on Brazilian company Cia. Brasileira de Metalurgia & Mineracao (CBMM). According to the US Geological Survey (USGS)’s report, Brazil, being the leader in terms of reserves deposits of niobium, produced 50 thousand tons of metal in 2015.

According to Bloomberg’s estimates, world demand for niobium is 90 thousand to 100 thous. tons per year (demand for copper, for example, is 23.3 million tons per year). In the period from 2000 to 2010, demand for niobium increased by an average of 10%, which was due to growing demand for steel in the BRICS countries. About 90% of the total world consumption of niobium accounts for ferroniobium mainly applied in the steel industry. Major ferroniobium consumers are the US, Japan and China.

Due to the fact that the price of niobium makes up a small percentage in total cost of steel, its future use will most likely be increased in all end-use segments. In 2000, 1 ton of steel required just 40g of ferroniobium, but already in 2008 it took 63 grams per ton. Bloomberg analysts note that both the US and Europe have included niobium in the list of strategically important minerals.

source: bloomberg.com

Although the prices of niobium fell last year due to a decrease in demand for steel, there were at least 15 companies competing with China Molybdenum for the right to buy these assets. Among them were the global leader in the phosphate fertilizers production Mosaic, Australian producer of coal and steel South32 and Swiss chemical company EuroChem Group AG.

Niobium is a severe refractory metal opened in 1801, used in production since 1925. Possessing high ductility, corrosion resistance and good weldability, niobium is used in to produce more durable and light steel for manufacture of industrial pipes and aircraft parts.

About 85% of the world's supply of niobium falls on Brazilian company Cia. Brasileira de Metalurgia & Mineracao (CBMM). According to the US Geological Survey (USGS)’s report, Brazil, being the leader in terms of reserves deposits of niobium, produced 50 thousand tons of metal in 2015.

According to Bloomberg’s estimates, world demand for niobium is 90 thousand to 100 thous. tons per year (demand for copper, for example, is 23.3 million tons per year). In the period from 2000 to 2010, demand for niobium increased by an average of 10%, which was due to growing demand for steel in the BRICS countries. About 90% of the total world consumption of niobium accounts for ferroniobium mainly applied in the steel industry. Major ferroniobium consumers are the US, Japan and China.

Due to the fact that the price of niobium makes up a small percentage in total cost of steel, its future use will most likely be increased in all end-use segments. In 2000, 1 ton of steel required just 40g of ferroniobium, but already in 2008 it took 63 grams per ton. Bloomberg analysts note that both the US and Europe have included niobium in the list of strategically important minerals.

source: bloomberg.com