Metals, Oil and Food Crops to be Dearer

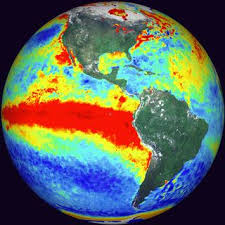

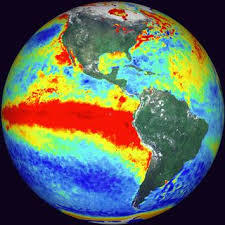

El Niño, the hot water current in the Pacific Ocean that symbolizes a unique but disruptive meteorological phenomenon, is expected to strike once again in the second half of 2015. This current runs from the middle of the Atlantic Ocean and close to the cost of Brazil.

However the disruptive meteorological phenomenon has had wide spread influence in far off places and influenced climate change signified by unseasonal rains and cyclones and exceptionally long dry spells.

Experts are of the view that this time El Niño would affect the prices of food stuff and hamper the production of hydro electricity in adjoining countries especially in Brazil.

This warning was issued by Credit Suisse, one of the world’s largest investment banks. Its analysts, quoting a research note, have already sent the warning to its clients.

“Meteorological evidence across the Pacific indicates a strong El Niño event in 2H15,” the Credit Suisse note to clients read.

The note says that the prices of industrial and precious metals may also receive a shot in the arm.

This meteorological phenomenon associated with El Niño has been termed as the Southern Oscillation that occur every two to seven years when warmer waters from the western Pacific move eastwards towards North and South America.

Countries and regions in the South East Asia, the Pacific region, Australia, Latin America and the US would witness either wetter weather or droughts. However the impact on Europe would be relatively limited.

This abnormal climatic condition would result in a reduction of crop yield which would tend to push up the retail prices. The change in prices would however be evident after a period of about twelve months as this is normally the period when future prices rise due to a shortfall in crop production in the US. The report noted that it would be an advantage for the retailers.

It is predicted that the rainfall in Australia can drop by 28%, as well as there are prediction s of poor monsoons in South East Asia. However there would be fewer hurricanes in the Caribbean and western Atlantic.

This would result in the wheat production in Australia and palm oil in South East Asia taking the majority of the hit of El Niño. It is expected that the metals and mining sector would also be affected by El Niño. Nickel production in Indonesia might see a slowdown. In the countries like China, Chile, Brazil and the US, there are possibilities of disruption n the production of hydroelectric power.

Julia Dawson, head of the team of analysts at Credit Suisse said that the disruption and reduction in hydro electric power would result in the growing demand for coal and oil across the Asia Pacific.

“Initial Asian oil demand shock translates into global oil shock six months later”, explained Dawson.

The influence of El Nino on the metal and mineral market is evident from history. Credit Susie noted that every time when there is a strong El Nino, the S&P GSCI Industrial Metals index has on average risen by 10.4% and the S&P GSCI Precious Metals index by another 12.4%.approximately 12 months from the occurrence of the phenomenon.

Credit Susie pointed out the US natural gas producers might be another potential loser affected by El Nino.

(source: http://www.digitallook.com)

However the disruptive meteorological phenomenon has had wide spread influence in far off places and influenced climate change signified by unseasonal rains and cyclones and exceptionally long dry spells.

Experts are of the view that this time El Niño would affect the prices of food stuff and hamper the production of hydro electricity in adjoining countries especially in Brazil.

This warning was issued by Credit Suisse, one of the world’s largest investment banks. Its analysts, quoting a research note, have already sent the warning to its clients.

“Meteorological evidence across the Pacific indicates a strong El Niño event in 2H15,” the Credit Suisse note to clients read.

The note says that the prices of industrial and precious metals may also receive a shot in the arm.

This meteorological phenomenon associated with El Niño has been termed as the Southern Oscillation that occur every two to seven years when warmer waters from the western Pacific move eastwards towards North and South America.

Countries and regions in the South East Asia, the Pacific region, Australia, Latin America and the US would witness either wetter weather or droughts. However the impact on Europe would be relatively limited.

This abnormal climatic condition would result in a reduction of crop yield which would tend to push up the retail prices. The change in prices would however be evident after a period of about twelve months as this is normally the period when future prices rise due to a shortfall in crop production in the US. The report noted that it would be an advantage for the retailers.

It is predicted that the rainfall in Australia can drop by 28%, as well as there are prediction s of poor monsoons in South East Asia. However there would be fewer hurricanes in the Caribbean and western Atlantic.

This would result in the wheat production in Australia and palm oil in South East Asia taking the majority of the hit of El Niño. It is expected that the metals and mining sector would also be affected by El Niño. Nickel production in Indonesia might see a slowdown. In the countries like China, Chile, Brazil and the US, there are possibilities of disruption n the production of hydroelectric power.

Julia Dawson, head of the team of analysts at Credit Suisse said that the disruption and reduction in hydro electric power would result in the growing demand for coal and oil across the Asia Pacific.

“Initial Asian oil demand shock translates into global oil shock six months later”, explained Dawson.

The influence of El Nino on the metal and mineral market is evident from history. Credit Susie noted that every time when there is a strong El Nino, the S&P GSCI Industrial Metals index has on average risen by 10.4% and the S&P GSCI Precious Metals index by another 12.4%.approximately 12 months from the occurrence of the phenomenon.

Credit Susie pointed out the US natural gas producers might be another potential loser affected by El Nino.

(source: http://www.digitallook.com)