By 2023, the industry will reach $ 2.5 trillion due to the constant growth of investments in this technology, as well as interest from leading international financial corporations.

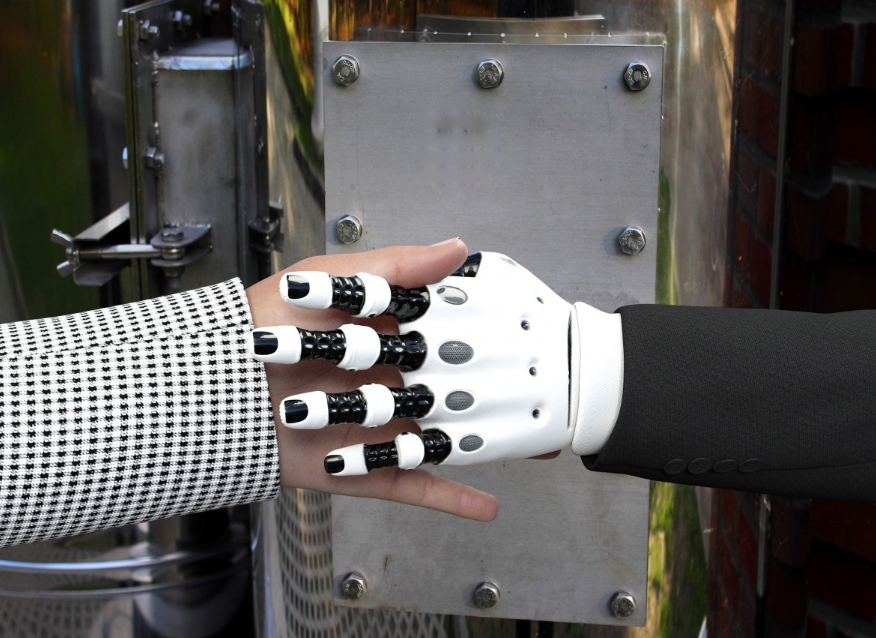

The rapid growth of investments in the growing segment of automated financial consultations will lead to the fact that in 2020 this industry will grow by 47% compared to 2019 and will reach $ 1.4 trillion. That is exactly how much, according to the specialized financial portal LearnBonds, the total amount of assets under management in the robo-advising segment will be. By 2023, the industry size will reach $ 2.5 trillion. The first such systems appeared in 2008, when, due to the financial crisis, small investors were looking for asset managers with minimal fees. American startups Betterment and Wealthfront were among the first to offer such services, since then the number of roboadvisers has grown to several hundred.

As such, roboadvisor uses special software and mathematical algorithms that allow recommending certain investments to the client depending on the current market situation, investor funds, wishes for investment behavior strategies, risk levels, preferences for investment sectors, etc. At present, most of the deals are observed in the USA ($ 1 trillion). The second largest transaction volume with the help of robotic advisers is noted China ($ 312 billion). The five largest countries in the roboadvising market include the UK ($ 24 billion), Germany ($ 13 billion) and Canada ($ 8 billion).

source: learnbonds.com

The rapid growth of investments in the growing segment of automated financial consultations will lead to the fact that in 2020 this industry will grow by 47% compared to 2019 and will reach $ 1.4 trillion. That is exactly how much, according to the specialized financial portal LearnBonds, the total amount of assets under management in the robo-advising segment will be. By 2023, the industry size will reach $ 2.5 trillion. The first such systems appeared in 2008, when, due to the financial crisis, small investors were looking for asset managers with minimal fees. American startups Betterment and Wealthfront were among the first to offer such services, since then the number of roboadvisers has grown to several hundred.

As such, roboadvisor uses special software and mathematical algorithms that allow recommending certain investments to the client depending on the current market situation, investor funds, wishes for investment behavior strategies, risk levels, preferences for investment sectors, etc. At present, most of the deals are observed in the USA ($ 1 trillion). The second largest transaction volume with the help of robotic advisers is noted China ($ 312 billion). The five largest countries in the roboadvising market include the UK ($ 24 billion), Germany ($ 13 billion) and Canada ($ 8 billion).

source: learnbonds.com