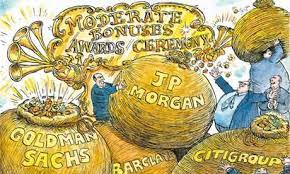

Bankers in New York and London are bracing for year-end bonuses that are expected to be 30% to 50% lower, with some receiving none at all as dealmaking slows and economic gloom sets in.

According to recruiters and compensation experts, financiers will be disappointed when their compensation awards arrive in the first quarter, and thousands more of their colleagues may be laid off after hundreds were laid off this year.

As the economy recovered from the pandemic, the industry gave out the most awards since 2006.

However, the pace of mergers and acquisitions and stock offerings has slowed dramatically this year as debt financing markets have collapsed and stock market volatility has harmed valuations.

The likelihood of a recession grew as the year progressed, as the Federal Reserve aggressively raised interest rates to combat inflation, cooling economic activity.

According to data provided to Reuters by Sheffield Haworth, a top executive recruitment firm, leaner times will likely translate into a 40% to 45% drop in average compensation for US managing directors at Goldman Sachs Group Inc in 2022.

According to the report, average pay for senior bankers at rival Morgan Stanley is expected to fall 35% to 40%, according to Julian Bell, Sheffield Haworth's head of the Americas, and Natalie Machicao, a vice president. It's a startling reversal for dealmakers who racked up record profits for their firms and pocketed huge bonuses last year.

"'Flat' is once again the new 'up' this year, with most people just hoping not to see a significant cut in their compensation given how revenues for the industry as a whole have fallen," said Stephane Rambosson, London-based cofounder of Vici Advisory, which specializes in hiring senior investment bankers.

According to Sheffield Haworth, average total compensation for U.S. managing directors at JPMorgan Chase & Co will fall by 35% to 40%, while pay for senior bankers at Citigroup Inc and Bank of America Corp will likely fall by 35% and 30%, respectively.

While the estimates are based on averages, payouts can vary significantly based on individual and group performance. Banks refused to comment.

According to Wall Street Prep, a company that helps aspiring bankers train for the industry, managing directors at Wall Street banks typically earn $350,000 to $600,000 per year, with bonuses of one or two times their base pay. Top performers can earn millions of dollars in incentive compensation.

According to Dealogic data, the pay slump coincides with a 66% drop in global equity underwriting, or $517 billion in deal value, this year compared to 2021. According to the data, the total value of mergers and acquisitions fell 37% to $3.66 trillion by December 20 from an all-time high of $5.9 trillion the previous year.

The slowdown comes as the Federal Reserve of the United States and other central banks raise interest rates aggressively to combat inflation, which has slowed economic activity.

Other risks, such as economic uncertainty caused by the Ukraine conflict, tense US-China relations, and clogged supply chains, fueled volatility in certain markets.

Fixed income, currency, and commodities (FICC) traders outperformed their investment banking counterparts.

According to Bell at Sheffield Haworth, compensation for FICC traders will likely rise slightly or remain flat, while compensation for stock traders may fall slightly.

According to the bank's October results, FICC traders at Barclays doubled their revenues in the third quarter compared to the previous year, a bright spot that helped the bank beat expectations despite rising costs elsewhere.

Firms such as Morgan Stanley and Citigroup Inc have already reduced their workforces in response to worsening economic conditions. Following an initial round of layoffs this year, Goldman Sachs plans to lay off thousands of employees in the coming year to navigate a difficult environment, according to a source familiar with the matter.

Most large firms in the United Kingdom are currently discussing and allocating bonuses, with decisions typically not being announced until early next year. Barclays and HSBC have already begun to reduce staff in underperforming investment banking areas.

British banks are also under intense pressure to raise wages for their lower-wage employees in the UK, as rising inflation erodes household incomes. Following a backlash from lower-paid employees who missed out earlier this year, NatWest offered the majority of its 41,500 employees in the UK a pay increase and one-time cash sum.

"We expect bonus pools to reduce compared to last year, and there will be no bonuses at some institutions," said Sophie Scholes, a partner at leadership advisory firm Heidrick & Struggles in London.

A situation in which star performers are rewarded over their colleagues "will leave some disappointed," she said.

(Source:www.latestly.com)

According to recruiters and compensation experts, financiers will be disappointed when their compensation awards arrive in the first quarter, and thousands more of their colleagues may be laid off after hundreds were laid off this year.

As the economy recovered from the pandemic, the industry gave out the most awards since 2006.

However, the pace of mergers and acquisitions and stock offerings has slowed dramatically this year as debt financing markets have collapsed and stock market volatility has harmed valuations.

The likelihood of a recession grew as the year progressed, as the Federal Reserve aggressively raised interest rates to combat inflation, cooling economic activity.

According to data provided to Reuters by Sheffield Haworth, a top executive recruitment firm, leaner times will likely translate into a 40% to 45% drop in average compensation for US managing directors at Goldman Sachs Group Inc in 2022.

According to the report, average pay for senior bankers at rival Morgan Stanley is expected to fall 35% to 40%, according to Julian Bell, Sheffield Haworth's head of the Americas, and Natalie Machicao, a vice president. It's a startling reversal for dealmakers who racked up record profits for their firms and pocketed huge bonuses last year.

"'Flat' is once again the new 'up' this year, with most people just hoping not to see a significant cut in their compensation given how revenues for the industry as a whole have fallen," said Stephane Rambosson, London-based cofounder of Vici Advisory, which specializes in hiring senior investment bankers.

According to Sheffield Haworth, average total compensation for U.S. managing directors at JPMorgan Chase & Co will fall by 35% to 40%, while pay for senior bankers at Citigroup Inc and Bank of America Corp will likely fall by 35% and 30%, respectively.

While the estimates are based on averages, payouts can vary significantly based on individual and group performance. Banks refused to comment.

According to Wall Street Prep, a company that helps aspiring bankers train for the industry, managing directors at Wall Street banks typically earn $350,000 to $600,000 per year, with bonuses of one or two times their base pay. Top performers can earn millions of dollars in incentive compensation.

According to Dealogic data, the pay slump coincides with a 66% drop in global equity underwriting, or $517 billion in deal value, this year compared to 2021. According to the data, the total value of mergers and acquisitions fell 37% to $3.66 trillion by December 20 from an all-time high of $5.9 trillion the previous year.

The slowdown comes as the Federal Reserve of the United States and other central banks raise interest rates aggressively to combat inflation, which has slowed economic activity.

Other risks, such as economic uncertainty caused by the Ukraine conflict, tense US-China relations, and clogged supply chains, fueled volatility in certain markets.

Fixed income, currency, and commodities (FICC) traders outperformed their investment banking counterparts.

According to Bell at Sheffield Haworth, compensation for FICC traders will likely rise slightly or remain flat, while compensation for stock traders may fall slightly.

According to the bank's October results, FICC traders at Barclays doubled their revenues in the third quarter compared to the previous year, a bright spot that helped the bank beat expectations despite rising costs elsewhere.

Firms such as Morgan Stanley and Citigroup Inc have already reduced their workforces in response to worsening economic conditions. Following an initial round of layoffs this year, Goldman Sachs plans to lay off thousands of employees in the coming year to navigate a difficult environment, according to a source familiar with the matter.

Most large firms in the United Kingdom are currently discussing and allocating bonuses, with decisions typically not being announced until early next year. Barclays and HSBC have already begun to reduce staff in underperforming investment banking areas.

British banks are also under intense pressure to raise wages for their lower-wage employees in the UK, as rising inflation erodes household incomes. Following a backlash from lower-paid employees who missed out earlier this year, NatWest offered the majority of its 41,500 employees in the UK a pay increase and one-time cash sum.

"We expect bonus pools to reduce compared to last year, and there will be no bonuses at some institutions," said Sophie Scholes, a partner at leadership advisory firm Heidrick & Struggles in London.

A situation in which star performers are rewarded over their colleagues "will leave some disappointed," she said.

(Source:www.latestly.com)