In what is being tipped off as the preparations for a possible largest takeover of an American company by a Chinese firm, the tech market is abuzz with rumors of Micron Technology would be taken over by Tsinghua Unigroup, a Chinese company.

If reports are to be believed, the Chinese state owned company and the top chip maker in China, Tsinghua Unigroup, is preparing a $23 billion bid for Micron Technology. This bid would be the largest ever takeover bid by a Chinese company of an American firm after the $4.7 billion takeover of the American pork producer Smithfield Foods by Shuanghui International Holdings of China in 2013.

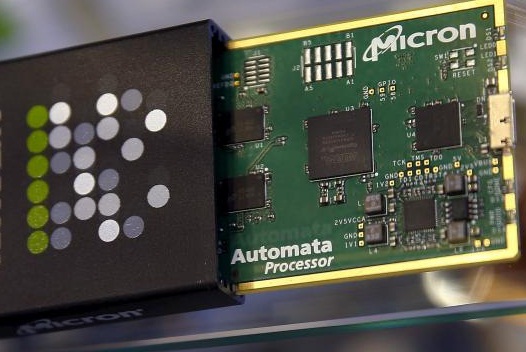

Micron Technology is one of the apex firms to produce chip in the United States.

Many experts however want to see this as the latest manifestation of the opening of a new chapter in the growing technological cold war between the United States and China.

This thought is confirmed by reports that the possible Chinese takeover of Micron would be faced with stiff obstacles from the US regulatory authorities. This is because the US regulators are viewing semiconductors as a strategic industry that plays an important role in the control over the technology market.

Semiconductor chips make up the heart and mind of billions of smart phones and computers and this is a reason that this takeover offer by the Chinese company is being viewed as a trade war was brewing between the United States and China. Both the countries are concerned about their control over chip production.

Amidst an environment of growing weariness about the technological production capacity of each other, China and the US could end up in a political tangle over the possible takeover bid. Both the countries are concerned over the state of security and technology is one of the critical factors to maintain adequate security levels.

The importance of Micron rests in its capacity to produce bulk memory chips. This is important as all the data in any computational task resides in the chips. The Boise, Idaho base company, Micron also manufactures high quality semiconductor chips that are used in global data centres, high-performance computing and flash memory. The products manufactured by the company is used in a varied of tasks ranging from placing web ads to maintaining jet engines.

The USP of Micron is its chips that have wires just 16 nanometres across. These are almost the smallest of chips available commercially. Such chips are essentially the one that provides an edge for computing tasks and technology. These are the reasons that experts feel would make the US regulators feel weary to allow the takeover. Micron is also among the last top notch companies to produce semiconductor chips with production units in the US and Asia. The deal is likely to be opposed in the US in the wake of concerns of the loss of the ability to make advanced memory chips in the US.

The deal would also be critically controlled by Intel Corporation that holds over 20% of stake in the Chinese conglomerate.

(Source:http://www.nytimes.com)

If reports are to be believed, the Chinese state owned company and the top chip maker in China, Tsinghua Unigroup, is preparing a $23 billion bid for Micron Technology. This bid would be the largest ever takeover bid by a Chinese company of an American firm after the $4.7 billion takeover of the American pork producer Smithfield Foods by Shuanghui International Holdings of China in 2013.

Micron Technology is one of the apex firms to produce chip in the United States.

Many experts however want to see this as the latest manifestation of the opening of a new chapter in the growing technological cold war between the United States and China.

This thought is confirmed by reports that the possible Chinese takeover of Micron would be faced with stiff obstacles from the US regulatory authorities. This is because the US regulators are viewing semiconductors as a strategic industry that plays an important role in the control over the technology market.

Semiconductor chips make up the heart and mind of billions of smart phones and computers and this is a reason that this takeover offer by the Chinese company is being viewed as a trade war was brewing between the United States and China. Both the countries are concerned about their control over chip production.

Amidst an environment of growing weariness about the technological production capacity of each other, China and the US could end up in a political tangle over the possible takeover bid. Both the countries are concerned over the state of security and technology is one of the critical factors to maintain adequate security levels.

The importance of Micron rests in its capacity to produce bulk memory chips. This is important as all the data in any computational task resides in the chips. The Boise, Idaho base company, Micron also manufactures high quality semiconductor chips that are used in global data centres, high-performance computing and flash memory. The products manufactured by the company is used in a varied of tasks ranging from placing web ads to maintaining jet engines.

The USP of Micron is its chips that have wires just 16 nanometres across. These are almost the smallest of chips available commercially. Such chips are essentially the one that provides an edge for computing tasks and technology. These are the reasons that experts feel would make the US regulators feel weary to allow the takeover. Micron is also among the last top notch companies to produce semiconductor chips with production units in the US and Asia. The deal is likely to be opposed in the US in the wake of concerns of the loss of the ability to make advanced memory chips in the US.

The deal would also be critically controlled by Intel Corporation that holds over 20% of stake in the Chinese conglomerate.

(Source:http://www.nytimes.com)