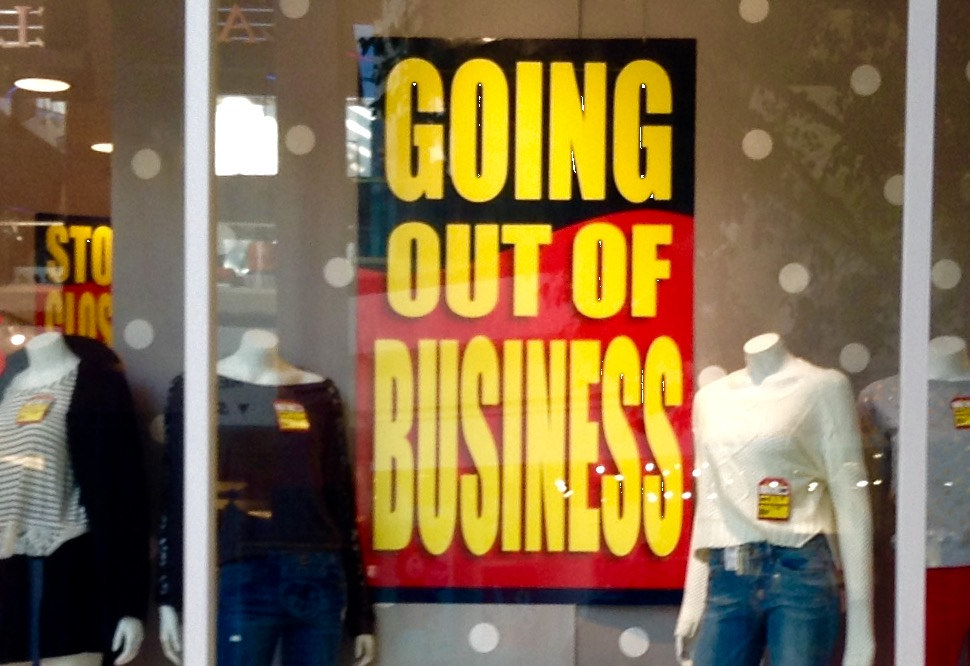

Thus, certain circumstances such as improvement of the economic situation, stimulating monetary policy, resulted in a decrease in number of bankruptcies occurred in 16 of the 23 European countries surveyed, including France (minus 9%), Spain (18%), Portugal (minus 23%), Sweden (by 5%).

Number of German companies that were declared bankrupt decreased by 6%, to 1.8 thousand per month, including due to weakness of the euro, which stimulates the growth of exports. In the UK, which is preparing for Brexit, the number of ruined companies grew by 10% in 2016, up to 4.5 thousand a month.

In the US, number of companies ruined in 2016 was 2% less than a year earlier. At the same time, America continues to be the world leader by number of corporate bankruptcies. 25,000 companies out of 30 million operating companies go bankrupt on a monthly basis.

In China, which economy is in the stage of gradual deceleration, volatility of the number of bankruptcies remains quite high against the background of their small number (150-200 per month).

At the same time, the Japanese economy is still trapped in low rates and low growth. However, the number of ruined Japanese companies has updated the historical minimum and decreased by 4% by 2015, to about 700 per month. The reason lies in the fact that Japanese banks are loyal to the practice of debt restructuring, the country has facilitated access for small and medium-sized companies to financing, and in general, debtors prefer gradual winding-down of a business to the expensive bankruptcy procedure.

In general, according to D&B, number of bankruptcies declined in 9 out of 11 surveyed countries in the Asia-Pacific region.

American Dun & Bradstreet, established in 1841, is the world's most famous source of data on companies and related credit risks.

source: dnb.com

Number of German companies that were declared bankrupt decreased by 6%, to 1.8 thousand per month, including due to weakness of the euro, which stimulates the growth of exports. In the UK, which is preparing for Brexit, the number of ruined companies grew by 10% in 2016, up to 4.5 thousand a month.

In the US, number of companies ruined in 2016 was 2% less than a year earlier. At the same time, America continues to be the world leader by number of corporate bankruptcies. 25,000 companies out of 30 million operating companies go bankrupt on a monthly basis.

In China, which economy is in the stage of gradual deceleration, volatility of the number of bankruptcies remains quite high against the background of their small number (150-200 per month).

At the same time, the Japanese economy is still trapped in low rates and low growth. However, the number of ruined Japanese companies has updated the historical minimum and decreased by 4% by 2015, to about 700 per month. The reason lies in the fact that Japanese banks are loyal to the practice of debt restructuring, the country has facilitated access for small and medium-sized companies to financing, and in general, debtors prefer gradual winding-down of a business to the expensive bankruptcy procedure.

In general, according to D&B, number of bankruptcies declined in 9 out of 11 surveyed countries in the Asia-Pacific region.

American Dun & Bradstreet, established in 1841, is the world's most famous source of data on companies and related credit risks.

source: dnb.com