Faced with renewed hostilities between Israel and Iran, major shipping lines are increasingly rerouting vessels away from the Strait of Hormuz, a critical maritime chokepoint that channels one‑fifth of the world’s oil supply. What was once considered routine transit is now fraught with missile threats, insurance uncertainties and crew‑safety dilemmas. As tensions escalate, ocean carriers weighing risk against cost are opting instead for longer—but safer—passage around the Arabian Peninsula, marking a significant shift in global shipping patterns.

Escalating Hostilities and Heightened Security Risks

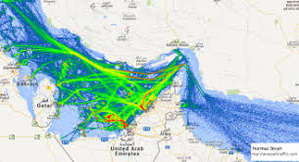

The Strait of Hormuz links the Persian Gulf to the Arabian Sea via a narrow, 21‑mile‑wide corridor. Each year, nearly 20 million barrels of crude and refined petroleum products traverse these waters, along with container boxes bound for transshipment hubs in the United Arab Emirates and beyond. Any disruption in this slender passage instantly reverberates through energy markets and supply chains, but recent airstrikes and missile exchanges have cast a pall over its once‑steady flow.

Safety has become the paramount concern. Since Israel’s preemptive air raids on Iranian military installations, both navies and air forces have maintained high alert levels. Civilian crews—many hailing from nonaligned nations—face the daunting prospect of being caught in crossfire or detained by regional authorities. Shipping companies, increasingly mindful of crew welfare and reputational risk, are reluctant to send vessels into a zone where a single miscalculation could result in damage, injury or extended detention.

Insurance underwriters, too, are signaling caution. While war‑risk premiums for the Strait of Hormuz have not yet doubled, the window for coverage renewal has narrowed, with some policies valid only 48 hours before entry into “high‑risk” areas. Underwriters reserve the right to spike premiums on short notice, creating financial uncertainty for charterers. Carriers calculating potential liability now face the prospect of single‑voyage surcharges in the low‑six‑figure range, eroding the thin margins that define bulk and tanker shipping.

Economic Calculus: Balancing Longer Routes Against Rising Costs

Economic calculus rarely favors voluntary detours, but market dynamics are shifting. Freight rates on very large crude carriers (VLCCs) bound for Asia have already jumped by more than 20 percent in a single trading session, reflecting the perceived risk of Gulf transit. Container spot rates, historically less volatile, are also creeping upward as shippers factor in longer voyage durations and the added cost of rerouting through the Suez Canal—or all the way around southern Africa if Red Sea routes remain threatened by insurgent activity.

Logistical complications compound the financial impact. Port rotations must be recalibrated to accommodate longer distances, meaning warehouses and feeder services at transshipment hubs require rescheduling. Cargo owners face extended delivery windows, and just‑in‑time manufacturing plants—particularly in Europe and Asia—risk component shortages. Energy markets, already jittery over geopolitical headlines, adjust pricing models daily as spot traders factor in longer tanker voyages and uncertain Gulf throughput.

Governments, meanwhile, are scrambling to offer assurances. Naval task forces from multiple Western countries have bolstered patrols in the Gulf of Oman and the northern Arabian Sea, but ships can only call on protection in designated “safe lanes.” Private maritime security firms, which thrived during the height of Somali piracy a decade ago, are once again pitching armed guards and citadel‑hardened safe rooms. These measures, however, add complexity to port calls—seafarers often struggle to secure visas for armed teams, and some ports bar security contractors altogether.

Rerouting Strategies and Impacts on Global Supply Chains

The industry’s reticence raises broader questions about energy security and strategic maritime infrastructure. Even temporary rerouting of oil tankers creates spare‑capacity constraints that push gasoline and diesel prices higher at the pump. Refiners accustomed to steady Middle Eastern crude grades must source alternate grades from West Africa or Russia, potentially disrupting refinery yields. Governments are monitoring strategic reserves more closely, coordinating releases to smooth price spikes.

For containerized trade, the shift away from Hormuz may prove more enduring. Dubai’s Jebel Ali Port, historically a linchpin for Gulf transshipment, already saw container volumes dip during the Red Sea crisis. A protracted avoidance of Hormuz could prompt long‑term network redesigns, with carriers consolidating ships at ports in Oman or even diverting cargo to Indian and East African gateways, reshaping supply‑chain footprints across the region.

Looking ahead, shipping groups are evaluating multi‑modal alternatives that bypass maritime chokepoints altogether. Overland corridors—from rail links across Central Asia to pipelines and road networks—are being reconsidered for critical cargos. While these routes cannot carry the freight volumes of a tanker or containership, they provide a hedge against sudden maritime closures.

The cumulative effect of these trends is an ongoing reappraisal of risk, cost and reliability. For decades, the Strait of Hormuz represented both efficiency and vulnerability: a narrow funnel enabling swift movement of oil and goods, yet perilously exposed to regional flare‑ups. As the Israel‑Iran conflict continues, shipowners must weigh the calculus anew, deciding whether the premium for speed and proximity outweighs the perils of transiting the Gulf.

In the short term, modest drops in Hormuz transits signal an industry exercising caution. But should skirmishes persist—or draw in external powers—shipping groups may solidify alternative routes as standard practice, with long‑lasting implications for global trade. The world’s navies and insurers can’t eliminate geopolitical risk, but carriers can choose where and when to run it. For now, the Strait of Hormuz stands as a corridor in crisis, its fate intertwined with the broader strategic tussle playing out thousands of miles from its narrow waters.

(Source:www.cnbc.com)

Escalating Hostilities and Heightened Security Risks

The Strait of Hormuz links the Persian Gulf to the Arabian Sea via a narrow, 21‑mile‑wide corridor. Each year, nearly 20 million barrels of crude and refined petroleum products traverse these waters, along with container boxes bound for transshipment hubs in the United Arab Emirates and beyond. Any disruption in this slender passage instantly reverberates through energy markets and supply chains, but recent airstrikes and missile exchanges have cast a pall over its once‑steady flow.

Safety has become the paramount concern. Since Israel’s preemptive air raids on Iranian military installations, both navies and air forces have maintained high alert levels. Civilian crews—many hailing from nonaligned nations—face the daunting prospect of being caught in crossfire or detained by regional authorities. Shipping companies, increasingly mindful of crew welfare and reputational risk, are reluctant to send vessels into a zone where a single miscalculation could result in damage, injury or extended detention.

Insurance underwriters, too, are signaling caution. While war‑risk premiums for the Strait of Hormuz have not yet doubled, the window for coverage renewal has narrowed, with some policies valid only 48 hours before entry into “high‑risk” areas. Underwriters reserve the right to spike premiums on short notice, creating financial uncertainty for charterers. Carriers calculating potential liability now face the prospect of single‑voyage surcharges in the low‑six‑figure range, eroding the thin margins that define bulk and tanker shipping.

Economic Calculus: Balancing Longer Routes Against Rising Costs

Economic calculus rarely favors voluntary detours, but market dynamics are shifting. Freight rates on very large crude carriers (VLCCs) bound for Asia have already jumped by more than 20 percent in a single trading session, reflecting the perceived risk of Gulf transit. Container spot rates, historically less volatile, are also creeping upward as shippers factor in longer voyage durations and the added cost of rerouting through the Suez Canal—or all the way around southern Africa if Red Sea routes remain threatened by insurgent activity.

Logistical complications compound the financial impact. Port rotations must be recalibrated to accommodate longer distances, meaning warehouses and feeder services at transshipment hubs require rescheduling. Cargo owners face extended delivery windows, and just‑in‑time manufacturing plants—particularly in Europe and Asia—risk component shortages. Energy markets, already jittery over geopolitical headlines, adjust pricing models daily as spot traders factor in longer tanker voyages and uncertain Gulf throughput.

Governments, meanwhile, are scrambling to offer assurances. Naval task forces from multiple Western countries have bolstered patrols in the Gulf of Oman and the northern Arabian Sea, but ships can only call on protection in designated “safe lanes.” Private maritime security firms, which thrived during the height of Somali piracy a decade ago, are once again pitching armed guards and citadel‑hardened safe rooms. These measures, however, add complexity to port calls—seafarers often struggle to secure visas for armed teams, and some ports bar security contractors altogether.

Rerouting Strategies and Impacts on Global Supply Chains

The industry’s reticence raises broader questions about energy security and strategic maritime infrastructure. Even temporary rerouting of oil tankers creates spare‑capacity constraints that push gasoline and diesel prices higher at the pump. Refiners accustomed to steady Middle Eastern crude grades must source alternate grades from West Africa or Russia, potentially disrupting refinery yields. Governments are monitoring strategic reserves more closely, coordinating releases to smooth price spikes.

For containerized trade, the shift away from Hormuz may prove more enduring. Dubai’s Jebel Ali Port, historically a linchpin for Gulf transshipment, already saw container volumes dip during the Red Sea crisis. A protracted avoidance of Hormuz could prompt long‑term network redesigns, with carriers consolidating ships at ports in Oman or even diverting cargo to Indian and East African gateways, reshaping supply‑chain footprints across the region.

Looking ahead, shipping groups are evaluating multi‑modal alternatives that bypass maritime chokepoints altogether. Overland corridors—from rail links across Central Asia to pipelines and road networks—are being reconsidered for critical cargos. While these routes cannot carry the freight volumes of a tanker or containership, they provide a hedge against sudden maritime closures.

The cumulative effect of these trends is an ongoing reappraisal of risk, cost and reliability. For decades, the Strait of Hormuz represented both efficiency and vulnerability: a narrow funnel enabling swift movement of oil and goods, yet perilously exposed to regional flare‑ups. As the Israel‑Iran conflict continues, shipowners must weigh the calculus anew, deciding whether the premium for speed and proximity outweighs the perils of transiting the Gulf.

In the short term, modest drops in Hormuz transits signal an industry exercising caution. But should skirmishes persist—or draw in external powers—shipping groups may solidify alternative routes as standard practice, with long‑lasting implications for global trade. The world’s navies and insurers can’t eliminate geopolitical risk, but carriers can choose where and when to run it. For now, the Strait of Hormuz stands as a corridor in crisis, its fate intertwined with the broader strategic tussle playing out thousands of miles from its narrow waters.

(Source:www.cnbc.com)