The Central Bank of Venezuela announced the exchange rate of the sovereign Bolivar, a new national currency, released on Monday. The US dollar now costs 60 bolivars, the euro - 68.65 bolivars. Taking into account the fact that the denomination of the national currency was carried out simultaneously (five zeros disappeared from the denominations), in fact, the official rate was devalued by 96%. Earlier it was about 250 thousand bolivars for $ 1, while at the black market you could buy the hard currency for 4 million bolivars (that is, for 40 new bolivars).

The government of the country has already announced plans for liberalization of currency control, but so far all the restrictions on the movement of capital have been preserved. It is only announced that the exchange will be held at special auctions, the first of which was scheduled for August 22. It is assumed that citizens of the country will be able to purchase a maximum of $ 500 per month, while according to the country's finance minister Simon Zerpa Delgado, the currency’s offer should be provided by the market, not by the Central Bank. The first legal exchangers will be opened only in September.

The authorities promise to tie the new currency to the Venezuelan crypto currency Petro, the cost of one unit of which equates to price of a barrel of oil produced in the country (sales of crypto-currencies were launched in March, it could be purchased for several foreign currencies, as well as other crypto-currencies). Venezuela hopes that the monetary reform will stop the record hyperinflation, the level of which amounted to 125% only by the end of July, exceeding 82.7 thousand percent on an annualized basis. This assessment was provided by the head of the Finance Commission of the National Assembly of Venezuela, Rafael Guzman. Official data on price increases have not been published since 2015. Earlier, experts of the International Monetary Fund predicted that by the end of the year, inflation could reach 1 million percent, while GDP would be reduced by 18 percent.

President Nicolas Maduro announced that the average salary would be raised to a level of 1.8 thousand new bolivars ($ 30, equivalent to an increase of 3.4 thousand per cent). Equally large-scale consequences may also result from the refusal to artificially lower fuel prices. While petrol in Venezuela is the cheapest in the world, its cost, even under the old exchange rate, did not exceed 1-6 bolivars. This led to mass smuggling of fuel to neighboring countries. In conclusion, the country announced an increase in the VAT rate from 12% to 16%.

Due to the sharp divergence of official and market rates, cash payment transactions have already become extremely inconvenient. Now the Central Bank of the country has actually launched unlimited emissions. On the black market, the rate of the denominated bolivar is already exceeding the official rate. Acceleration of inflation can also break all records and reach astronomical 44 million percent by the end of the year, the Venezuelan economist Toro Hardy said on Globovision television channel. According to him, the government "releases money without even printing them, and sends them digitally," so there is "the world's first digital hyperinflation."

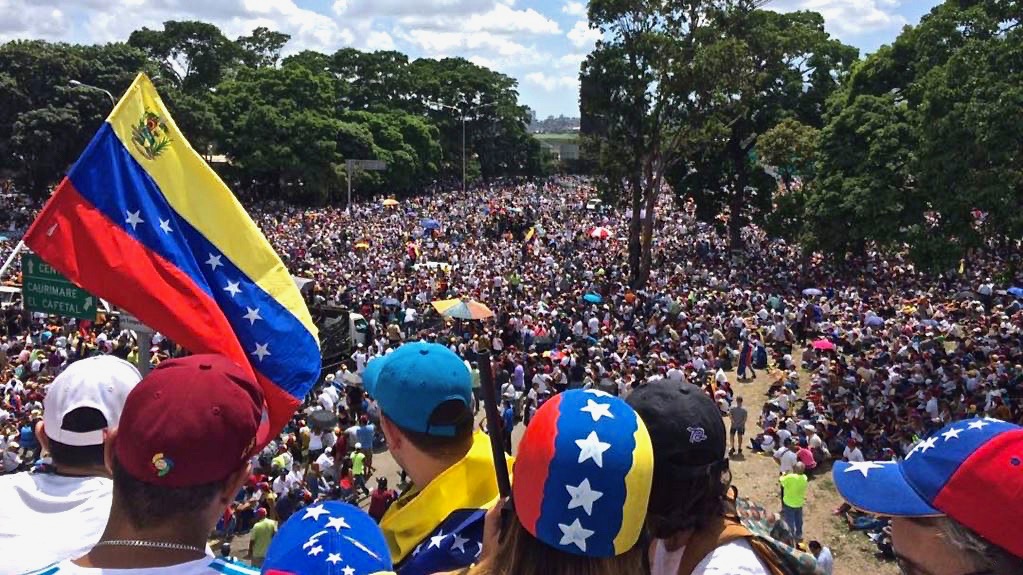

source: reuters.com

The government of the country has already announced plans for liberalization of currency control, but so far all the restrictions on the movement of capital have been preserved. It is only announced that the exchange will be held at special auctions, the first of which was scheduled for August 22. It is assumed that citizens of the country will be able to purchase a maximum of $ 500 per month, while according to the country's finance minister Simon Zerpa Delgado, the currency’s offer should be provided by the market, not by the Central Bank. The first legal exchangers will be opened only in September.

The authorities promise to tie the new currency to the Venezuelan crypto currency Petro, the cost of one unit of which equates to price of a barrel of oil produced in the country (sales of crypto-currencies were launched in March, it could be purchased for several foreign currencies, as well as other crypto-currencies). Venezuela hopes that the monetary reform will stop the record hyperinflation, the level of which amounted to 125% only by the end of July, exceeding 82.7 thousand percent on an annualized basis. This assessment was provided by the head of the Finance Commission of the National Assembly of Venezuela, Rafael Guzman. Official data on price increases have not been published since 2015. Earlier, experts of the International Monetary Fund predicted that by the end of the year, inflation could reach 1 million percent, while GDP would be reduced by 18 percent.

President Nicolas Maduro announced that the average salary would be raised to a level of 1.8 thousand new bolivars ($ 30, equivalent to an increase of 3.4 thousand per cent). Equally large-scale consequences may also result from the refusal to artificially lower fuel prices. While petrol in Venezuela is the cheapest in the world, its cost, even under the old exchange rate, did not exceed 1-6 bolivars. This led to mass smuggling of fuel to neighboring countries. In conclusion, the country announced an increase in the VAT rate from 12% to 16%.

Due to the sharp divergence of official and market rates, cash payment transactions have already become extremely inconvenient. Now the Central Bank of the country has actually launched unlimited emissions. On the black market, the rate of the denominated bolivar is already exceeding the official rate. Acceleration of inflation can also break all records and reach astronomical 44 million percent by the end of the year, the Venezuelan economist Toro Hardy said on Globovision television channel. According to him, the government "releases money without even printing them, and sends them digitally," so there is "the world's first digital hyperinflation."

source: reuters.com