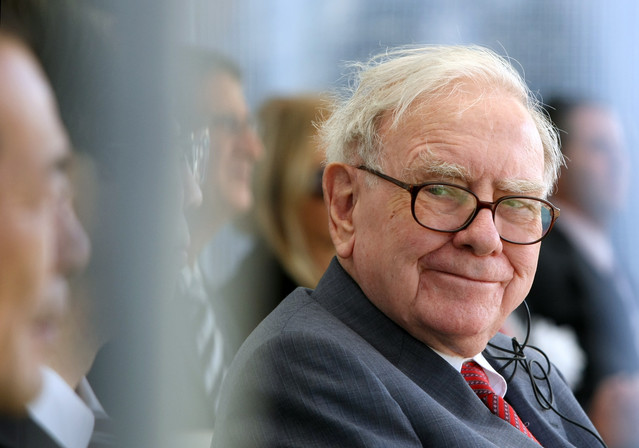

Berkshire Hathaway Inc. has dropped the biggest hint yet that its future chief executive could either be “insurance head” Ajit Jain or energy boss Greg Abel, as its founders indicated the $363 billion conglomerate is ready for a future without them.

Berkshire Chairman Warren Buffett and Vice Chairman Charles Munger, in separate letters to shareholders, defended the company’s sprawling structure and argued why it should stay in place after they are gone. Mr. Buffett didn’t name his successor, but Mr. Munger suggested Mr. Jain or Mr. Abel would be worthy replacements.

The India-born Mr. Jain is credited with building Berkshire’s massive reinsurance business from scratch. Mr. Abel, meanwhile, is a Canadian who joined Berkshire through its 2000 purchase of a utility company, and has built it into a large energy provider supplying 11 million customers globally.

Berkshire released the two letters, as it celebrated its 50th year under the control of Mr. Buffett, 84, and his right-hand man Mr. Munger, 91. Although the fourth-quarter earnings dropped 17% to $4.16 billion, and the yearly profit figure rose by 2% to $19.9 billion.

The vice chairman, who normally doesn’t write shareholder letters, offered the strongest guidance on the company’s next leader. Berkshire, he wrote, would remain a “better-than-normal” company, with its current collection of businesses, even if Mr. Buffett left the company tomorrow, if his successors were persons of only moderate ability and if Berkshire wouldn’t buy another large business again.

However Mr. Munger added:

Berkshire Chairman Warren Buffett and Vice Chairman Charles Munger, in separate letters to shareholders, defended the company’s sprawling structure and argued why it should stay in place after they are gone. Mr. Buffett didn’t name his successor, but Mr. Munger suggested Mr. Jain or Mr. Abel would be worthy replacements.

The India-born Mr. Jain is credited with building Berkshire’s massive reinsurance business from scratch. Mr. Abel, meanwhile, is a Canadian who joined Berkshire through its 2000 purchase of a utility company, and has built it into a large energy provider supplying 11 million customers globally.

Berkshire released the two letters, as it celebrated its 50th year under the control of Mr. Buffett, 84, and his right-hand man Mr. Munger, 91. Although the fourth-quarter earnings dropped 17% to $4.16 billion, and the yearly profit figure rose by 2% to $19.9 billion.

The vice chairman, who normally doesn’t write shareholder letters, offered the strongest guidance on the company’s next leader. Berkshire, he wrote, would remain a “better-than-normal” company, with its current collection of businesses, even if Mr. Buffett left the company tomorrow, if his successors were persons of only moderate ability and if Berkshire wouldn’t buy another large business again.

However Mr. Munger added:

“But under this Buffett-soon-leaves assumption, his successors would not be of only ‘moderate ability’. For instance, Ajit Jain and Greg Abel are proven performers who would probably be under-described as ‘world-class.’...each is a better business executive than Buffett.”

Neither of the two executives is likely to leave Berkshire Hathaway or want to change the company’s structure in a big way, according to Mr. Munger.

Berkshire Hathaway is a massive holding company with more than 80 operating businesses including a railroad, insurance companies and candy, as well as a $117 billion portfolio of stocks. Mr. Buffett is known for letting his managers run their businesses with minimal interference. In recent years, he has outlined a succession plan that would split his role into three.

He already has picked two investment managers who will eventually take over his stock-picking function and suggested to the board that his son Howard Buffett, a farmer, be made the company’s non-executive chairman. Mr. Buffett has said he and the board have picked a CEO successor.

Mr. Munger appeared to be making a hypothetical case in naming the two men in his letter. But analysts and Berkshire shareholders have long speculated Mr. Jain, 63, is the most likely candidate to succeed Mr. Buffett as CEO, although Mr. Abel, 52, has been another name on investors’ short lists.

For his part, Mr. Buffett said his successor would have to be a “rational, calm and decisive individual” with the ability to allocate capital and “fight off the ABCs of business decay, which are arrogance, bureaucracy and complacency.”

In the section of his letter addressing the future of Berkshire, Mr. Buffett didn’t list any candidates by name. However, he said the board and he believe Berkshire has the –

“…right person to succeed me as CEO ... In certain important respects, this person will do a better job than I am doing.”

Mr. Buffett filled the rest of his 15-page “past, present and future” section of the letter with anecdotes, reminiscences and self-deprecating humor, while expressing optimism about the future of the U.S. and Berkshire Hathaway. He discussed why Berkshire makes sense as it is currently structured — the centrality of Berkshire’s “special culture” to its economic health and the value of being a conservative player. He also said that diversification was key to Berkshire’s profitability.

References:

http://www.bloomberg.com/news/articles/2015-06-29/who-will-succeed-warren-buffett-as-ceo-of-berkshire-hathaway- -