In general, sales of graphics adapters are always lower in the first quarter, and distributors and retailers are selling components from warehouses on the eve of the summer lull. The III quarter is usually opened with announcement of new products and preparations for Christmas sales, which makes the second half of the year a period of stable growth in supply.

The general decline in the personal computer market contributed to a decline in demand for graphics accelerators. This year, however, the situation has changed dramatically. Excessive demand for video cards from crypto-currency producers, who first devastated all stocks of Radeon cards, and then started to buy out GeForce, led to the fact that shipments of discrete graphics accelerators in the II quarter of this year increased by 30.9%.

At the same time, the first wave of boom for mining occurred back in 2013: then Bitcoin and Litecoin were mined. In addition, the miners recognized devices such as ASIC (application specific integrated circuits) more promising for the production of crypto-currency.

However, Ethereum crypto currency uses the Ethash algorithm, which works with ASIC inefficiently, but the video cards are just right. The growth in demand for high-performance graphic accelerators used by miners has also affected the aggregate statistics, which are counted on discrete and integrated solutions together. Thus, the total GPU shipments in the second quarter of 2017 increased by 7.2% compared to the first quarter, and by 6.4% compared to the second quarter of last year.

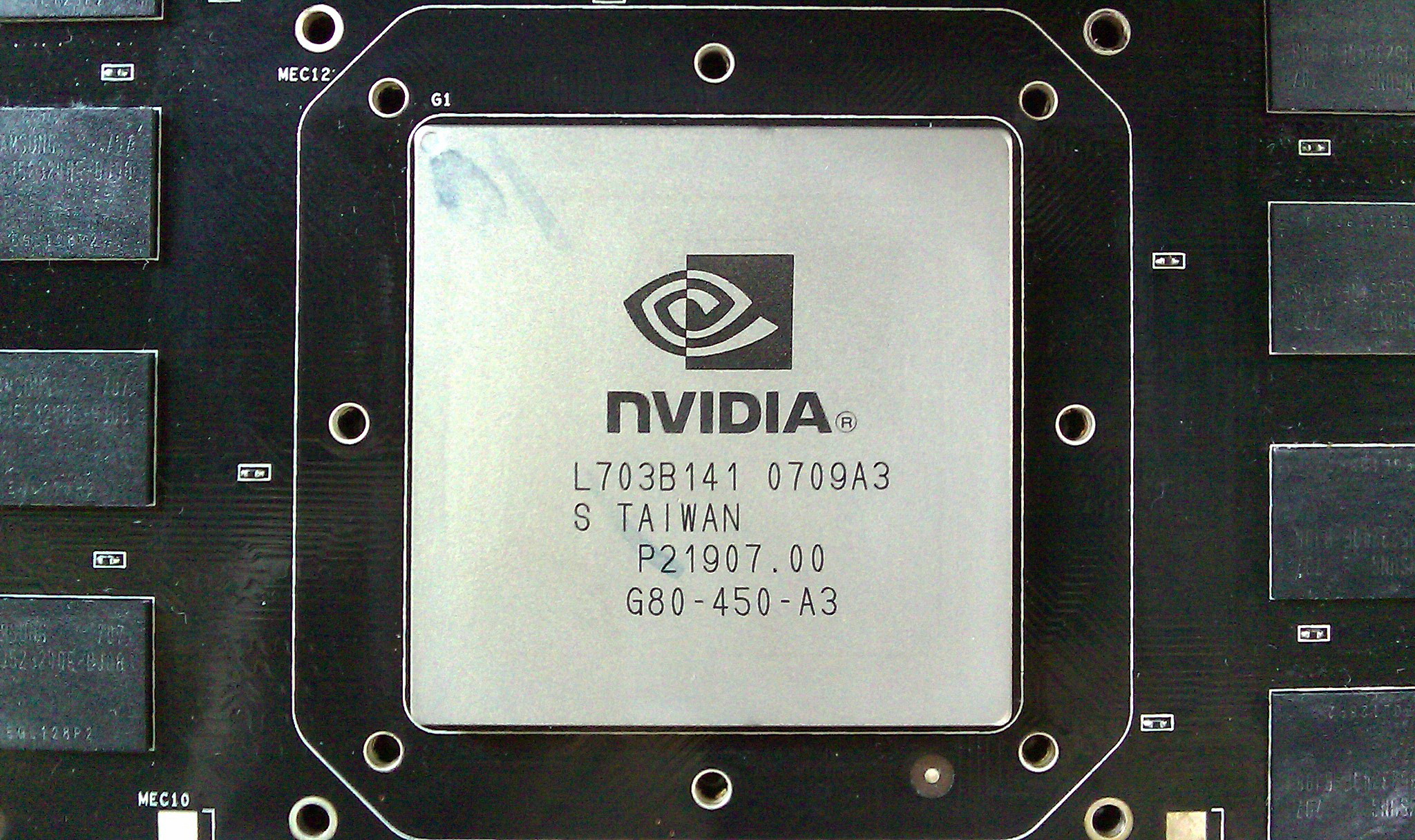

In recent quarters, NVIDIA has recorded a sharp increase in demand for its products. This allows the company to demonstrate a significant improvement in its financial performance, which also regularly surpasses Wall Street forecasts.

Thus, in the second quarter of 2018, which ended on July 30, the company's revenue increased by 56% yoy to a record $ 2.23 billion, exceeding the consensus forecast of $ 1.96 billion, with a noticeable increase in all divisions. The main source of revenue remains the segment of gaming GPU, sales in which rose by 52% to $ 1.19 billion.

Competing AMD challenged Nvidia by announcing RX Vega 64 video card, which is contrasted with the flagship GeForce GTX 1080 card, and RX Vega 56 is the most popular among the GeForce GTX 1070 gamers. It is noteworthy that earlier AMD competed with Nvidia on a more budget segment: for example, its RX 480 card was opposed to the NVIDIA GeForce GTX 1060. The price of the new video card is set at $ 499, and starting August 28, the Radeon RX Vega 56 will go on sale at a price of $ 399.

At the moment, Nvidia controls more than 80% of the market of video cards in the world, and the quality of its products is a considerable merit in this industry. And, it seems that the company will continue to hold the palm of the championship, despite AMD’s challenge. The performance of Radeon RX Vega 56 and Radeon RX Vega 64 corresponds to the parameters of NVIDIA GTX 1070 and GTX 1080 cards respectively. According to Yahoo! Finance, in August 38 analysts have recommendations on shares of Nvidia. Of these, 14 experts propose to "buy" these securities.

source: finance.yahoo.com

The general decline in the personal computer market contributed to a decline in demand for graphics accelerators. This year, however, the situation has changed dramatically. Excessive demand for video cards from crypto-currency producers, who first devastated all stocks of Radeon cards, and then started to buy out GeForce, led to the fact that shipments of discrete graphics accelerators in the II quarter of this year increased by 30.9%.

At the same time, the first wave of boom for mining occurred back in 2013: then Bitcoin and Litecoin were mined. In addition, the miners recognized devices such as ASIC (application specific integrated circuits) more promising for the production of crypto-currency.

However, Ethereum crypto currency uses the Ethash algorithm, which works with ASIC inefficiently, but the video cards are just right. The growth in demand for high-performance graphic accelerators used by miners has also affected the aggregate statistics, which are counted on discrete and integrated solutions together. Thus, the total GPU shipments in the second quarter of 2017 increased by 7.2% compared to the first quarter, and by 6.4% compared to the second quarter of last year.

In recent quarters, NVIDIA has recorded a sharp increase in demand for its products. This allows the company to demonstrate a significant improvement in its financial performance, which also regularly surpasses Wall Street forecasts.

Thus, in the second quarter of 2018, which ended on July 30, the company's revenue increased by 56% yoy to a record $ 2.23 billion, exceeding the consensus forecast of $ 1.96 billion, with a noticeable increase in all divisions. The main source of revenue remains the segment of gaming GPU, sales in which rose by 52% to $ 1.19 billion.

Competing AMD challenged Nvidia by announcing RX Vega 64 video card, which is contrasted with the flagship GeForce GTX 1080 card, and RX Vega 56 is the most popular among the GeForce GTX 1070 gamers. It is noteworthy that earlier AMD competed with Nvidia on a more budget segment: for example, its RX 480 card was opposed to the NVIDIA GeForce GTX 1060. The price of the new video card is set at $ 499, and starting August 28, the Radeon RX Vega 56 will go on sale at a price of $ 399.

At the moment, Nvidia controls more than 80% of the market of video cards in the world, and the quality of its products is a considerable merit in this industry. And, it seems that the company will continue to hold the palm of the championship, despite AMD’s challenge. The performance of Radeon RX Vega 56 and Radeon RX Vega 64 corresponds to the parameters of NVIDIA GTX 1070 and GTX 1080 cards respectively. According to Yahoo! Finance, in August 38 analysts have recommendations on shares of Nvidia. Of these, 14 experts propose to "buy" these securities.

source: finance.yahoo.com