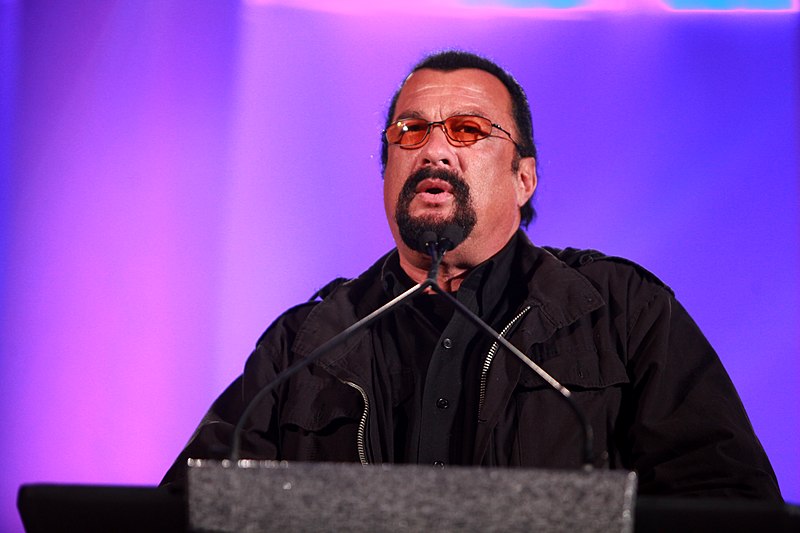

According to SEC, the startup promised to pay Seagal $ 250 thousand in cash and another $ 750 thousand with B2G tokens for ICO promotion, which included the actor posting social media posts urging not to miss the upcoming token placement.

In addition, Bitcoiin2Gen issued a press release titled "Zen Master Steven Seagal has become the face of the Bitcoiin2Gen brand," which stated that Segal supports the ICO "with all his heart."

Officially, the SEC believes that any cryptocurrency created as a result of an ICO should be regarded as a security and, accordingly, be subject to existing disclosure requirements and investor protection laws.

The regulator requires celebrities or any other private individuals promoting digital currencies to disclose the type and amount of compensation received for these services.

“Investors in the ICO had the right to know about the rewards received by Seagal, or promised to him for the promotion of the placement, in order to be able to decide on how biased he is,” said Kristina Littman, who is responsible for cybercrime law enforcement at the SEC.

"Celebrities do not have the right to use their authority on social networks to advertise securities without proper disclosure of remuneration data," Littman said.

Under the terms of the agreement with the regulator, the 67-year-old Seagal will return the illegally obtained income of $ 157 thousand (his real income from B2G advertising plus interest), as well as will pay a fine of another $ 157 thousand, without admitting guilt or refuting the facts revealed by the SEC.

In addition, he is prohibited from participating in the advertising of securities, including digital, for three years.

source: theverge.com

In addition, Bitcoiin2Gen issued a press release titled "Zen Master Steven Seagal has become the face of the Bitcoiin2Gen brand," which stated that Segal supports the ICO "with all his heart."

Officially, the SEC believes that any cryptocurrency created as a result of an ICO should be regarded as a security and, accordingly, be subject to existing disclosure requirements and investor protection laws.

The regulator requires celebrities or any other private individuals promoting digital currencies to disclose the type and amount of compensation received for these services.

“Investors in the ICO had the right to know about the rewards received by Seagal, or promised to him for the promotion of the placement, in order to be able to decide on how biased he is,” said Kristina Littman, who is responsible for cybercrime law enforcement at the SEC.

"Celebrities do not have the right to use their authority on social networks to advertise securities without proper disclosure of remuneration data," Littman said.

Under the terms of the agreement with the regulator, the 67-year-old Seagal will return the illegally obtained income of $ 157 thousand (his real income from B2G advertising plus interest), as well as will pay a fine of another $ 157 thousand, without admitting guilt or refuting the facts revealed by the SEC.

In addition, he is prohibited from participating in the advertising of securities, including digital, for three years.

source: theverge.com